The Stanbery Building and E.M. Stanbery & Co., Bankers

Elias Millen Stanbery, attorney, banker, and entrepreneur, foresaw the coming of a railroad along the Muskingum River and the beneficial effect it would have on the economy of Morgan County. Mr. Stanbery helped organize Brown-Manly Plow company and many other businesses. In 1884, he erected the Stanbery building in McConnelsville for retail, office, and lodging space, and in 1885 the railroad arrived.

In 1886, to help meet the needs of an expanding economy, Mr. Stanbery established a new banking firm: E. M. Stanbery & Co., Bankers, the first of a series of banking firms. He would be the dominant influence in their development and expansion for the next 30 years. Banking offices were located in the recently completed Stanbery Building, and there they have remained, enlarged and remodeled from time to time. On November 19, 1886, the McConnelsville Herald reported: Among the new establishments in town, and among the most substantial and important, is the new banking firm of E. M. Stanbery & Co., Bankers. Having fitted up the east room of the Stanbery Block in the most modern and improved good fashion, they are now ready to do business of all kinds pertaining to the banking institution.

Founding of Citizens Bank and Early History

E. M. Stanbery & Co., Bankers was comprised of E. M. Stanbery and Charles Leslie Alderman, opening for business on November 8, 1886, with assets of $23,000.00. In 1887, the firm expanded, adding four more partners: Azra Alderman, the second President of the First National Bank of McConnelsville, James Donahue, William Sherwood and William O. Sherwood. The name was changed to the Citizens Bank and opened for business July 5, 1887 with assets of $116,000.00.

In 1892, the partners changed the form of the firm from a partnership to a stock company by establishing the Citizens Bank of McConnelsville under the banking laws of the State of Ohio. Its incorporators were Azra Alderman, Charles Leslie Alderman, James Donahue, John Miller, Cleason B. Reed, William O. Sherwood, Elias Millen Stanbery, and G. Adolphus Vogle. It opened for business on June 5, 1892 and operated successfully until 1900, when the Citizens National Bank of McConnelsville was organized.

The McConnelsville Herald, on December 23, 1892 reported: This bank was organized in 1886 as a private bank with a capital of one hundred thousand dollars. Its business has been successful from the start. In June last it was incorporated under the laws of Ohio, with a capital of one hundred and forty thousand dollars and ten thousand dollars surplus, making it the strongest bank in the county. Its Board of Directors is composed of the following persons, well-known among the most careful and responsible citizens of Morgan County, to-wit: E. M. Stanbery, Azra Alderman, John Miller, James Donahue and W. O. Sherwood; E. M. Stanbery, President; C. L. Alderman, Cashier. The bank is provided with a fire-proof vault and one of Hall's best burglar-proof safes with time lock, insuring depositors the greatest degree of safety. A general banking business is conducted, generous treatment is extended to all its customers and the rules of careful banking are carefully adhered to and strictly enforced. This bank deserves and receives the generous support of the business community.

Conversion to a National Bank and The Citizens Savings & Loan Co.

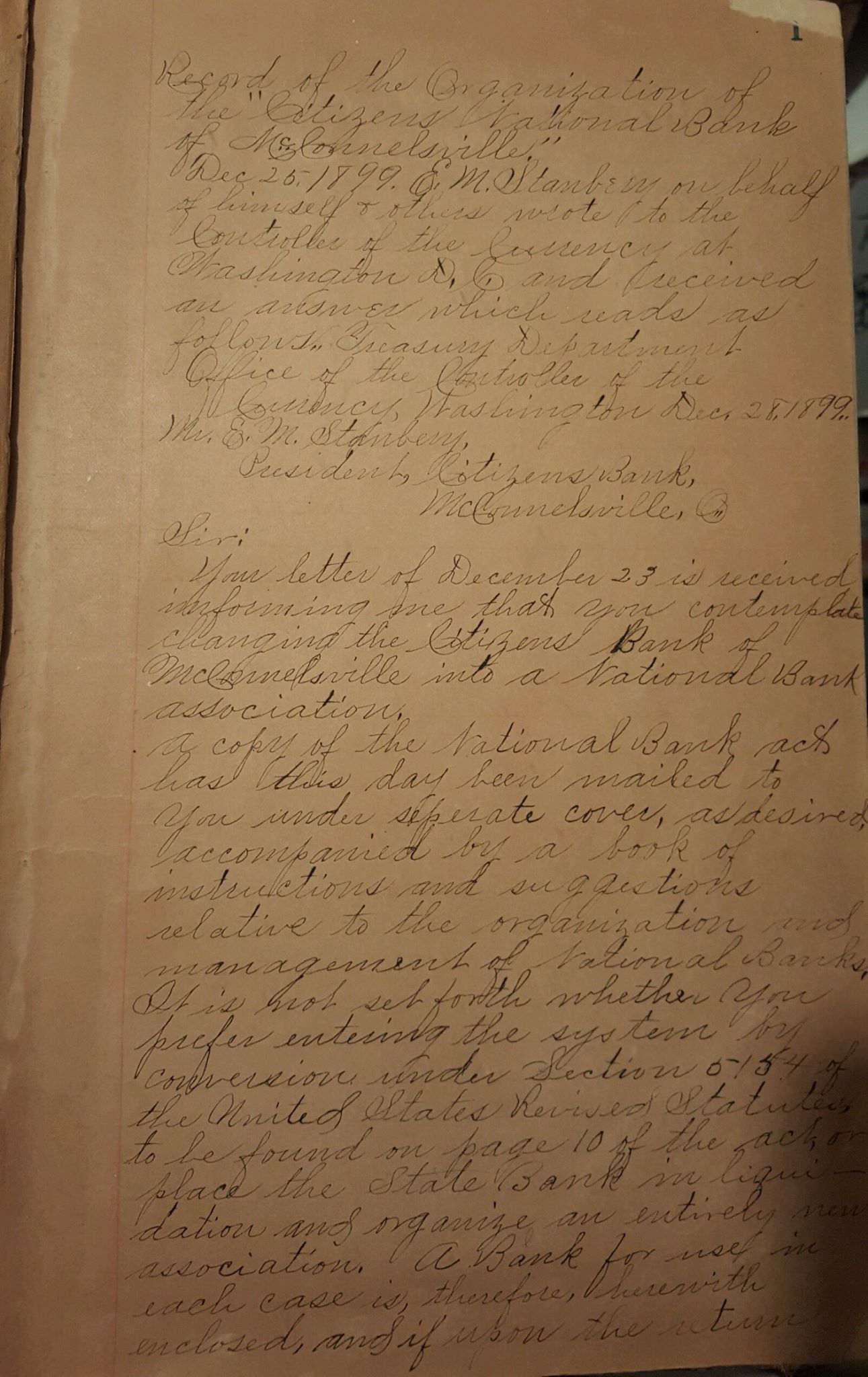

On December 23, 1899, Mr. Stanbery, who was the President of The Citizens Bank of McConnelsville, wrote to the Office of the Comptroller of the Currency in Washington, D.C. Mr. Stanbery and others at the bank expressed their desire for The Citizens Bank of McConnelsville to become a National Bank association. The response received on December 28, 1899, from the OCC granted Mr. Stanbery and the Citizens Bank of McConnelsville a National Bank association status, providing instructions and suggestions relative to establishing the organization and management of the new National Bank.

On December 23, 1899, Mr. Stanbery, who was the President of The Citizens Bank of McConnelsville, wrote to the Office of the Comptroller of the Currency in Washington, D.C. Mr. Stanbery and others at the bank expressed their desire for The Citizens Bank of McConnelsville to become a National Bank association. The response received on December 28, 1899, from the OCC granted Mr. Stanbery and the Citizens Bank of McConnelsville a National Bank association status, providing instructions and suggestions relative to establishing the organization and management of the new National Bank.

Picture of Lobby in 1900s to see what Citizens National Bank of McConnelsville's lobby looked like during the early 1900s. Another inside picture of the lobby in the 1900s was an influence and inspiration for our current lobby design.

In 1905, an associated organization, the Citizens Savings and Loan Company, whose name was later changed to the Citizens Savings Bank of McConnelsville, was established under the laws of Ohio. It was closely associated with the Citizens National Bank through a high percentage of the shareholders and Board of Directors of both banks being the same individuals. The Savings Bank also occupied a segregated part of the National Bank facilities. It was organized primarily to provide the services of savings account and the real estate mortgage loans - services which at the time were not authorized for commercial National Banks.

The Citizens Savings and Loan Company's incorporators were: John W. Barkhurst, James Donahue, Alexander B. McIntire, Joseph Reed, Elias Millen Stanbery, and Elmer Taylor. It opened for business April 8, 1905, and for the next 35 years was an important unit in the financial facilities of Morgan County. Savings accounts and real estate mortgage loans, having been authorized for National Banks, the Savings Bank ceased to be a necessity. For more efficient use of limited space, the Savings Bank was liquidated. Its deposit liability with sufficient good real estate mortgage loans and other assets in amounts equal to the deposits were transferred to the National Bank. Additional funds, as they became available, were dispersed to the shareholders in liquidating dividends.

Establishing Capital and The 20th Century

The Citizens National Bank of McConnelsville was fourth in the sequence of Stanbery Banking Organizations and is their continuing entity. It is chartered under National Bank laws, and received Charter No. 5259 dated February 28th 1900. Its incorporators were: Elias Millen Stanbery, Azra Alderman, James Donahue, Alexander B. McIntire, Joseph Reed, William O. Sherwood, Elmer A. Taylor, Dr. Hiram L. True, G. Adolphus Vogle, Lewis J. Weber and A. Perl Whitaker.

The Citizens National Bank of McConnelsville opened for business March 1, 1900 with paid-in capital funds of one hundred thousand dollars ($100,000.00), divided into 1,000 shares sold at $100 each, and assets of one hundred forty-five thousand dollars ($145,000.00). The Citizens Bank of McConnelsville was being liquidated, and with its assets and liabilities transferred to the National Bank, that bank had an early rapid growth. The first 50 year period (1900-1950) in the life of the Citizens National Bank of McConnelsville was one of slow but satisfactory growth. National and local events influencing the economy of Morgan County and the bank's well-being were the money panics of the early nineteen hundreds, the formation of the Federal Reserve System, establishment of the Internal Revenue Service, the destructive 1913 Muskingum Valley Flood, formation of the Muskingum Valley Conservancy District and the construction of Ohio Power Company's power plant at Philo, Ohio, the disastrous depression of the 1930s, and the Second World War.

Morgan County had great difficulty recovering from the severe losses of the 1913 Flood. It required the stimulus of the First World War to re-establish a functioning economy. Over the years, the beneficial effect of that stimulus steadily declined; Morgan County's basic economy was agriculture, and because of its limited sources of employment, the county was losing population to the large cities. The salvation of Morgan County and of the Valley was the construction by Ohio Power Co. of an electric generating plant at Philo, Ohio. The employment created to construct the power plant, to open adjacent coal fields, to build a nearby electric furnace alloy plant, and to operate those facilities was of immediate and sustaining benefit.

It required several years and the economic benefit of the Second World War to pull the national economy out of the depths of the 1930s Depression. Morgan County did not receive much direct employment benefit from that war. Because of the limited capacity of Brown Manly Plow Co., its only producer of war material to manufacture such products, Morgan County continued to depend on the plants at Philo for its main source of employment. Successive Boards of Directors and Bank Officers, by adjusting time-and-experience-tested operational policies to meet changing conditions, successfully guided the bank through this 50 year period. In approximate figures, total assets increased from one hundred and forty-five thousand dollars ($145,000.00) to three million dollars ($3,000,000.00) and capital funds and reserves from one hundred thousand dollars ($100,000.00) to three hundred thousand dollars ($300,000.00) - satisfactory increases for that period.

The stimulus of the Second World War gradually declined until the Valley's economy had reached a "stagflation", a moving sideways level. Again, the initial lift came from the Ohio Power Company. Its announcement of the intention to construct an additional electric generating plant in the Beverly-Waterford area was the spark that re-ignited the economy. A steady flow of funds from their purchase of adjacent coal lands also was an early and sustaining factor. A subsequent lift in the economy came from the decision of Cleveland Graphite Bronze Co. to reduce their concentration of production in the Cleveland area and build smaller plants in various locations. McConnelsville was fortunate to be selected for one of those plants. The decision of Brodhead-Garrett to purchase the Taylor Woodcraft Co. of Malta, to move their Cleveland woodworking production to Malta, and to build their large plant in the Malta area also provided a stimulus to the local economy. The Directors of the Citizens National Bank can rightfully claim to have had an effective influence on the decisions of these companies to come to Morgan County.

Citizens National Bank also had its own national currency. A picture of a bank note worth ten dollars!

Expansion and Innovation

As our bank continued to grow during the latter half of the 20th century, operations expanded geographically. As a result, CNB opened a branch in Duncan Falls on December 12, 1996. While CNB's brick and mortar offices are located in Morgan and Muskingum Counties, thanks to the advent of technology, CNB is also excited to offer financial services beyond its physical locations via mobile devices and the Internet, with the same commitment to personal, reliable community banking.

Click on the following links to learn more about Internet Banking or Mobile Banking.

CNB Today

In addition to technology-based banking services, CNB remains committed to serving the areas in which our staff live. All of our board members have strong ties to Morgan and Muskingum County, with all of them being current or former business owners in our area. Our goals align with those of the people in the areas we serve. We are extremely dedicated to the economic and personal success of our communities and work closely with business leaders to strive toward excellence in the towns we represent.

Learn more about Citizens National Bank's Staff and Board of Directors by clicking Staff & Board of Directors Page.

Board of Directors and Executive Staff History

Throughout its rich history, The Citizens National Bank has been classified as a community bank. During that period, it has been the policy of community banks to assign to their Presidents the additional titles, authority, and responsibilities of Chairman of the Board of Directors and of Chief Executive Officer of the Bank. It is the duty of the Board of Directors to establish policy and of bank management to implement that policy and direct its observance. For much of its history, the Citizens National Bank followed this consolidation policy. However, during the Presidency of Justus R. Alderman and at his request, a visual and distinct separation of these functions was established, and Robert S. Christie was elected Chairman of the Board of Directors.

Combination Presidents:

1. Mr. Elias Millen Stanbery (1900-1918) served through the formative years of Citizens National Bank, including the periods of the 1913 Flood and the First World War. Mr. Stanbery was considerably the most prominent banker and businessman in Morgan County during the late 1800s and early 1900s. Due to his advanced age and ill health, Mr. Stanbery declined re-election at the 1919 annual meeting.

2. Mr. Thomas J. Bailey (1919-1929) was elected President to succeed E. M. Stanbery. Mr. Bailey had been a Director since 1908 had been of great help during Mr. Stanbery's latter years. Mr. Bailey was the logical replacement and served through the twenties. For personal reasons, Mr. Bailey declined re-election in 1930.

3. Mr. Robert F. Miller (1930-1933) became President in 1930. Mr. Miller was a full-time farmer, livestock dealer, and wool buyer. He soon realized that his bank duties required more time than he had available after tending to his business obligations, and he declined re-election in 1934.

Mr. Thomas J. Bailey (1934-1940) was persuaded to give up his retirement and return to the Presidency. His knowledge of local people and banking was of great value in guiding the bank through this recovery period. He declined reelection in 1941, but he remained a prominent member of the bank and community, serving on many committees and helping to direct banking policies as part of the Morgan County Bankers Association.

4. Mr. James J. Christie (1941-1951) was elected to follow Mr. Bailey. Mr. Christie, a highly successful local businessman, had been a great help to Mr. Bailey during the recovery period following the Great Depression. Under Mr. Christie’s able leadership, the Bank continued to grow and prosper. It was a sad day for the Bank and the community when an illness, that later caused his death, required his resignation from the Presidency.

5. Mr. Justus Reynolds Alderman (1951 - 1986) was elected President in 1951, following Mr. Christie's resignation, and served as President for much of the latter half of the 20th century. In 1976, the separation of functions was established, creating a distinct Chairman of the Board of Directors position, separate from the management of the bank. J. R. Alderman was a highly respected member of the community and perhaps the most recognized Bank President of the 20th century.

Board Chairs:

Mr. Robert S. Christie - Chairman of the Board of Directors (1976 - 1992) became the Chairman of the Board of Directors in 1976 for reasons explained above. Many in the community knew Mr. Christie as a man of great principle who oversaw the bank as Chairman of the Board through many changes during the 1970s and 1980s. Sadly, an illness that led to his death forced him to resign in March of 1992.

Mr. Robert James Christie - Chairman of the Board of Directors (1992 - 2020) was elected Chairman of the Board of Directors, following in the footsteps of his father, Mr. Robert S. Christie. Known throughout the community as Chris, Mr. Christie served as Chairman and CEO of the bank for many years. Under the oversight of Mr. Christie, Citizens National Bank continued to prosper.

Mr. John K. Christie - Chairman of the Board of Directors (2020 - Present) was elected Chairman of the Board of Directors in 2020. John was elected as the fourth generation Christie family member to hold the office of Chairman or President, following in the footsteps of his father, Mr. Robert J. Christie, his grandfather, Mr. Robert S. Christie, and his great grandfather, Mr. James J. Christie.

Presidents:

6. Mr. Lloyd D. Williams - President (1987 - 2000) was elected President in February 1987, but he had served as Executive Vice President since 1975, operating Citizens National Bank alongside President J.R. Alderman. A long-tenured employee of CNB, Mr. Williams started with the bank in 1955 as a management trainee under the GI Bill. Mr. Williams served as a board member following his Presidency until 2004. A highly respected leader in the community, Mr. Williams' near half-century with Citizens National Bank is fondly remembered.

7. Mr. Michael T. Vynalek - President (2000 - 2022) became President following the retirement of Lloyd D. Williams. During Mr. Vynalek's Presidency, Citizens National Bank utilized updated banking technology, implementing emerging software solutions and next generation products to meet changing customer needs. The Bank grew in assets to over $100 million during this time. Mr. Vynalek retired as President and Chief Executive Officer of The Citizens National Bank of McConnelsville on June 30, 2022.

8. Mr. Matthew A. Carpenter - President (2022 - Present) assumed the role of President on July 1, 2022, following the retirement of Mr. Vynalek. Mr. Carpenter previously served as Executive Vice President and Chief Operating Officer, and he is the current President of The Citizens National Bank of McConnelsville. Under Mr. Carpenter's leadership, our bank continues to flourish and look for new opportunities for growth and to reinvest in our community.

Additional Information

- Citizens National Bank reorganized on December 29th, 2000, under its parent company, CNB Holdings, Inc.

- Citizens National Bank of McConnelsville's Charter Number: 5259

- Citizens National Bank of McConnelsville's Routing Number: 044106397

- CNB's Federal Deposit Insurance Corporation (FDIC) Certificate Number: 6638

- CNB's Nationwide Mortgage Licensing System & Registry (NMLS) ID Number: 728366

- Newspaper article announcing the founding of the city of McConnelsville.